NPS for SaaS Businesses: 4 Things You Are Doing Wrong

NPS for SaaS Businesses: 4 Things You Are Doing Wrong

Everybody and their mother wants to know whether or not they are doing a good job.

The SaaS industry landscape, littered with startup after startup, all trying to be the next Dropbox or athenahealth, is cut-throat to say the least. SaaS companies are in a tug of war with each other over who offers the best service to customers, the most features during a free trial, even who has the most clever blog posts. As such, and in every industry, a company that desires to successfully grow, and remain profitable, needs to monitor and measure how well or poorly their business is doing. If the car is veering outside of the lane, then the driver needs to correct the steering. So, since time immemorial, varying metrics have been put in place to keep managers and executives informed of whether or not their efforts are paying off in profitability. This brings us to the net promoter score (NPS) survey. First formally introduced in 2003 as another business KPI (key performance indicator), in recent years there has been a lot of chatter and buzz over its efficacy. Some professionals tout NPS as the alpha and omega of a business’s success, while other deride it as plainly a waste of time. Before we get ahead of ourselves, if you are unfamiliar with NPS, we will quickly summarize the practice for you:

NPS In A Nutshell

NPS is a method of measuring loyalty to a brand, rather than plainly measuring customer satisfaction. Companies use NPS usually in the fashion of asking customer to rate on a scale of zero to ten (zero being the lowest, 10 being the greatest) how likely they are to recommend the product they purchased to others, be it friends, family, or colleagues. With regards to the SaaS industry, where the majority of company success comes from renewals of software subscriptions rather than primary sales, NPS has been accepted as a useful practice in efforts to not only reduce churn, but to spread highly coveted organic, word-of-mouth marketing. According to a Nielsen study, approximately 90% of customers trust brands based upon family or friend recommendations, over direct advertising. After all, when you ask a paying customer how likely they are to recommend your product to others in their circle of influence, you are planting the seed for them to go ahead and follow through with doing so. Well, that is if they actually do value your product. If not, never mind. Much in the same way that any business metric is used to measure facets of success, if NPS is improperly applied it is a waste of company time, money, and energy. Think of NPS as a lump of clay on a potter’s wheel – it really all depends on what you do with it, as you can either make a valuable vase or a piece of garbage. Today we are going to go over four of the most common mistakes that we see a lot of SaaS companies doing wrong with their NPS surveys, so that you can avoid the pitfalls of shoddy customer loyalty measurement.

1. Surveying The Free Trial Users

Not all customers are created equal. SaaS is a subscription dependent industry, and nearly every single SaaS company offers a free trial run of their software to lure in customers. However, a lot of SaaS enterprises will send an NPS survey to users towards the end of their free trial in an effort to engage users and convert them into paying subscribers. This is a waste of time, money, and will not engage the user. Of course, other methods should be employed to engage trial users, such as personalized messages, but an NPS survey is specifically used for measuring customer loyalty, not satisfaction. Ask yourself – how can a user be a loyal customer when they have not even purchased in the first place? A company’s resources regarding NPS should only be devoted to paying subscribers. Further, by NPS surveying free trial users, the data will be skewed. Many free trial users will be detractors of the product, often due to the product truly just not being useful for their purposes. So, NPS surveys should only be sent to paying customers, to accurately assess the level of your customer loyalty.

2. Failing to Segregate Responses

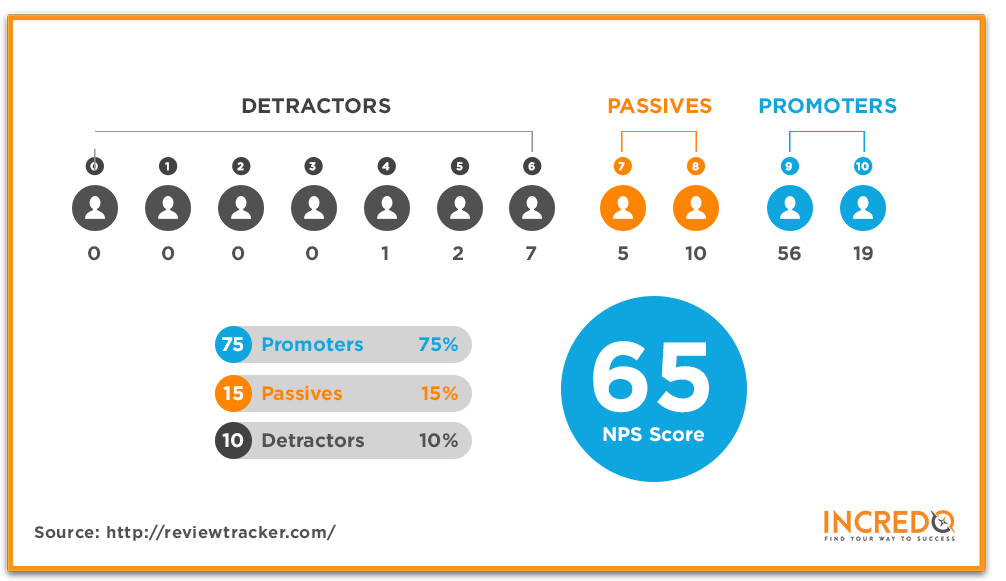

Obviously, NPS responses are divided into three categories: 1. Promoters (9-10) 2. Passives (7-8) 3. Detractors (0-6) However, this is not the only customer data that should be segregated. For example, if your SaaS comes in tiers of subscriber level, these segments of users should be exclusive from each other when monitoring NPS responses. Additionally, survey responses should also be segregated by customer tenure – for how long a customer has subscribed to the software. Neglecting to separate the NPS respondents based on their demographics and such will not give the company a clear understanding of how the product is valued, and how loyal their customers truly are or will be.

Obviously, NPS responses are divided into three categories: 1. Promoters (9-10) 2. Passives (7-8) 3. Detractors (0-6) However, this is not the only customer data that should be segregated. For example, if your SaaS comes in tiers of subscriber level, these segments of users should be exclusive from each other when monitoring NPS responses. Additionally, survey responses should also be segregated by customer tenure – for how long a customer has subscribed to the software. Neglecting to separate the NPS respondents based on their demographics and such will not give the company a clear understanding of how the product is valued, and how loyal their customers truly are or will be.

3. Failing to Follow Up

For some of you reading this article, the next NPS misstep may sound like a no-brainer, but some newer SaaS companies may not have the experience to really think NPS through, and thus make this mistake. Piggy-backing on the previous mistake, how customer responses should be segregated based upon demographic when factoring the data, SaaS companies need to make sure that they follow up with NPS responses in a segregated, response-appropriate manner. When a customer submits their NPS response, if a SaaS company simply collects the data they are missing out two vital opportunities for decreasing churn: 1. Further engaging the customer, fostering loyalty 2. Learning specifics on what is appreciated about their product, and what needs to be fixed Promoters, passives, and detractors alike need to be followed up with post-NPS, or your company will unconvert many a paying customer. Here are a few examples of how a SaaS company should follow-up with their NPS responders:

- For promoters, issue a follow-up that not only asks them what features they love the most about the product, but also thanks them personally for being a customer

- For passives, again, thank them personally, acknowledge that they like the product, but ask what would make them absolutely love it

- For detractors, gratitude once again, and ask for what they wish the product could do for their purposes, and identify what they didn’t like

The above examples are just that – examples – but now you have a general idea of how to follow through with your customers. While NPS is a terrific indicator for future growth, without follow-ups to survey responses, the initial data submitted is practically useless. Ask yourself, what is the point of measuring customer loyalty if you do not know what is causing (or deflating) it?

4. Putting Too Much Faith in NPS

Just to be clear, we are in no way advocating to not use NPS, or that it is not a valuable customer loyalty metric. However, too many SaaS companies value the surveys as diamonds, when really NPS is a bit closer to silver. Many SaaS companies have used NPS to tremendous success, such as Slack, to fuel extremely rapid growth. That being said, their use of NPS is a unique approach, and not one that will apply to every SaaS enterprise. The truth is that implementing NPS is not a comprehensive customer loyalty report, but rather a barometer for measuring general customer attitudes toward your product, and thus your company. What we are saying here is that NPS should be used, but it indeed has some shortcomings with regards to customer loyalty. Fred Reicheld, the creator of the NPS method, even admits that 60-80% of non-renewing customers are highly satisfied with the service they were using, but defected anyway. People change their minds, and human behavior is tricky to predict especially in the SaaS industry. SaaS companies rarely meet with their customers face-to-face, so it is an extra challenge to assess whether or not a customer is even genuinely satisfied when they submit their survey answer. This brings us back to the mention of how Slack has used NPS, along with the rest of their customer-centric company culture, to their benefit – it wasn’t just NPS by itself. As we wrote earlier in the article, word-of-mouth is the best marketing for any industry, not just SaaS. Only if you supplement NPS with other customer incentives to spread the gospel will your SaaS product become market salient.

What is the #1 Thing SaaS Companies Do With Their NPS?

The biggest thing a SaaS team can do improperly with their NPS is to not use NPS at all. There are a few pitfalls that can easily be avoided when implementing NPS, and if NPS is not wielded with deliberation and care it can be a huge waste for SaaS companies. Still, if you keep these common mistakes in mind, and channel your NPS as a customer engagement tool, it can be of undeniable value to fostering SaaS-customer relationships. For example, only 15% of customers sent an NPS survey will respond to it, so you will miss out on the opinions of the other 85%. However, if you consistently survey your new and renewing customers, you will feel the general pulse of your target market. If you have experience with NPS gone wrong, share your own insights in the comments below. Afterall, knowledge is power.

Tags:

SaaS Growth

October 31, 2016

Comments