Are You Calculating Your SaaS Marketing ROI in 2021 Like Outstanding SaaS Owners?

Are You Calculating Your SaaS Marketing ROI in 2021 Like Outstanding SaaS Owners?

“You can’t do marketing without tracking. Marketing doesn’t exist without tracking. In order to validate the existence of an online marketing team, you have to be able to track everything. In SaaS, it’s really critical. When I sit in front of management, I have to prove my campaign is working. If I run a campaign and track it and don’t get any conversions, I don’t do it again.”Debbie Cohen, VP of Online Marketing at Seculert

If there is one business type that is really reliant on information, accurate data interpretation and understanding what different numbers mean, it’s SaaS. One might argue that metrics and data are important for any type of business and he will be absolutely right. However, certain businesses (and their leaders) can, sometimes, choose to ignore metrics and trust their experience and personal insight and get away with it. With SaaS, there is no such choice: it’s only a one way game.<img “780px;”=”” src=”https://cdn2.hubspot.net/hubfs/463211/Blog-files/This-is-how-outstanding-SaaS-owners-calculate-marketing-ROI.png” alt=”This-is-how-outstanding-SaaS-owners-calculate-marketing-ROI.png” width=”780″ data-pagespeed-url-hash=”717988448″>As Stuart McDonald, CMO at FreshBooks, put it: “For a SaaS company, data and metrics are a cultural thing: they either matter or they don’t. You are in one camp or the other – there is no in between. Either you are analytically and data-driven, or you trust your instincts. The people who rely on their gut are wrong.” (Source) This is exactly why SaaS is so fragile. You don’t have any room for error, and since correct data interpretation, calculations and usage play an insanely huge role, you must be able to measure each crucial metric and understand its influence on the overall aspects of your business. In this article we will be taking a close, detailed look at a SaaS company’s sales and marketing (S&M) ROI, understand how to calculate it and what you can do as a business owner to increase your S&M ROI.

A handy list of abbreviations and definitions

In order to simplify the reading process, here is a list of abbreviations that you will encounter over the course of reading the article, accompanied with their definitions:

- Monthly Recurring revenue – MRR – The MRR is the amount of money that your SaaS business expects to get from a customer safely on a monthly basis

- Customer Acquisition Cost – CAC – the total cost of various activities needed to be performed in order to acquire one customer

- Months to recover CAC – the number of months needed for a SaaS business to recover the CAC through monthly payments (please note that for the sake of simplicity, this article ignores overhead costs)

- Customer lifetime Value – CLV – CLV is the amount of profit your company gains over a given number of months while maintaining successful business relationships with that customer

- Churn rate – the percentage of people that stop using your SaaS product after a given period of time (calculated in months)

The critical element that puts SaaS on a different scale

For most business models out there, revenue and cash flow calculations are pretty much the same and based on a simple model: you sell a product – you receive money for it.

What makes SaaS fundamentally different from other businesses (and therefore, much more complex than others), is that the revenue for a product/service sold comes during an extended period of time (MRR). Typically, SaaS businesses need to invest heavily upfront to acquire customers and then generate revenue over time. This leads to SaaS businesses having a negative cash flow at the start of acquiring customers, but the more customers you acquire, the better your cash flow curve will look in the end. In other words, the faster you grow, the better it will work out for you in the long run. Eventually, when you acquire enough customers, their combined monthly revenue will be enough to cover the expenses of acquiring new customers, and this is where your cash flow will slowly turn positive (assuming you keep marketing and sales expenses the same).

The problem with this business model is that it heavily depends on a constant flow of customers and retention. Inevitably, some customers will decide to leave you (also called churn) and stop using your services at some point.

In the best case scenario, you will have maintained the contract long enough to recover CAC before the customer leaves you. In the worst case, the customer will leave sooner, which means that you will not only make no money, but also lose a lot, since you spent a great deal to acquire that customer in the first place.

On the other hand, if customers like your product/service, they will stick around for a long time, and thus, increase your profits considerably. So in this case, we have to two essential sales processes to keep in mind: 1. Acquiring the customer 2. Retaining the customer While every business needs to have a solid customer base to keep operating, in the case of SaaS, retaining an existing customer is much more important than acquiring a new one. This is largely due to the accumulative revenue model of the business. The longer you can retain an existing customer, the higher your ROI will be at the end of each quarter. Many SaaS companies fail to recognize the importance of customer retention and oftentimes, take monthly renewals for granted. This can be a devastating blow to your business, up to a point where you will simply stop generating profits altogether. Here is a simple example that will help you understand what we learned above: If you spent $100 to acquire one new customer and the monthly revenue from that customer is $10, here is what happens: (this example ignores overhead costs, just for the sake of simplicity):

- In 10 months you will receive $100 from that customer, which means that will be even with your CAC. In this case, 10 is the number of months you need to recover CAC.

- In 11 months you will receive $110, which means that for 100 dollars spent, you get 10 dollars profit.

- In 20 months you will receive $200, which means that for 100 dollars spent, you get 100 dollars profits.

Notice how the profit from a longer retained customer increases in an arithmetic progression? 10>20>30>40>50>…100. This is why customer retention is one of the most important metrics for a SaaS business.

Key metrics that drive a SaaS business’s growth

Dan Martell who runs a big Youtube channel for SaaS entrepreneurs mentions the “5 Cs of SaaS Metrics“: Cash (How much money do you have on your bank account), Churn (How many customers did you lose), CMRR (it’s your monthly recurring revenue), CAC (how much money you spend to acquire a customer, including paid ads, commissions and other fees) and CLV (how much profit does your company get from a customer as a whole). We will discuss the importance in the sections below.

In order to calculate marketing ROI correctly, we need to dig deeper and understand the key factors of a SaaS company’s growth.

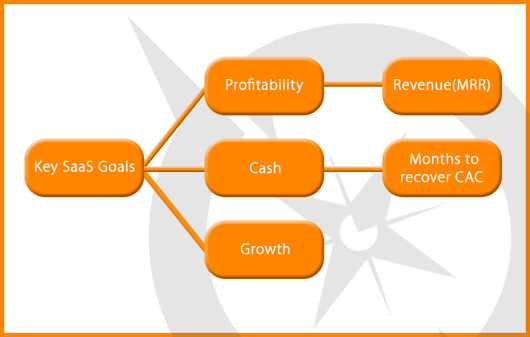

In order for a SaaS business to be successful, it needs three critical elements: growth, cash and profitability.

Growth is a critical element of establishing market leadership. Due to the nature of SaaS business being an “everything or nothing” type, aggressive growth is very important. Also, as the company grows further, a series of various events accelerate that growth even more: people talk about your company and increase word of mouth marketing, customers feel safer to work with industry leaders, which in turn decreases churn, your company receives more love and discussion on social media, etc.

Cash is mainly dependent on months to recover CAC as mentioned in the example above. The longer you retain your customers, the more cash you will have. Profitability is comprised of three things: Microeconomics (sales and marketing mainly), overall profitability and profitability per employee. Since we will be taking a look from a marketing perspective, we will drill down and discuss the sales and marketing and leave the rest out.

Growth

Growth is one of the critical factors for every SaaS business that wants to be successful. Due to the nature of SaaS earning more profits at the end of each consecutive year, even without acquiring any new customers, every single new customer can mean a lot in terms of profits. This is why every digit matters in this metric. SaaS growth is composed of a number of metrics:

- Conversion rates

- Lead generation growth

- Funnel capacity growth (sales people)

- Upselling new features

Conversion rates

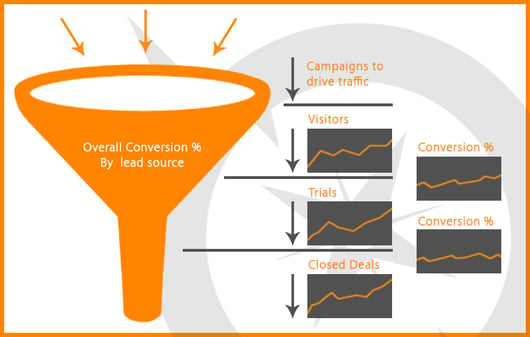

While conversion rates may vary depending on the number of steps in each sales funnel, a good way to look at this is to measure two things: the number of leads that go down into each step and the number of leads that convert and move further down the funnel.

This is an important aspect, which you will want to focus your marketing activities on. Depending on the marketing approach you decide to go with, different input and effort will be required, and the results will vary accordingly.

This is an important aspect, which you will want to focus your marketing activities on. Depending on the marketing approach you decide to go with, different input and effort will be required, and the results will vary accordingly.

You main objective will be to identity the top marketing techniques that drive the most conversions (ads, content marketing, referral marketing, trade show marketing, etc.) and focus on improving those methods even further.

Lead generation growth

Every potential customer represents tons of potential profit, so naturally, the more leads you acquire, the better for you in the long run. Two things to worry about here:

- Your leads need to be of high quality so that you don’t lose too much time on converting them

- The number of new leads should go in line with your funnel capacity, meaning that your sales team needs to be able to handle all the leads that are acquired from marketing activities (more on why this is important below).

Funnel capacity growth

Funnel capacity is basically the number of salespeople that can effectively handle a given number of leads and increase conversions. Funnel capacity is often overlooked by SaaS companies after they get a seemingly large number of sales reps and stop worrying about the matter. While the number of salespeople might be sufficient for a given period of time, as the number of your overall leads and conversions increase and your marketing activities improve, you will eventually be stuck at a point where the number of leads that can be effectively processed by sales reps will be significantly higher than the number of leads your sales team can effectively handle at a time. Going back to the point that each new customer boosts profits significantly, this can slow down the growth of your business, which will hurt your bottom line by a lot. This is one of the main reasons why inbound marketing is a great technique for SaaS companies to utilize. Due to the non-disruptive nature of inbound, it requires very few sales touches (the perfect scenario requiring zero touches) and you will be able to grow profoundly, without worrying about having the capacity to fuel your increasing number of leads.

Upselling new features

Innovation is a critical aspect for a SaaS product and typically, it happens quite frequently (and if not, it absolutely should!). A good way to grow the business further is to increase the monthly payments of customers, which helps decrease the number of months that is needed to recover CAC and at the same time, boosts profitability by the same amount. Upgrading your product and offering additional features to existing customers is a great and efficient way to grow the company even further. Upselling is generally easier to perform when you already have a billing contract, and most importantly, it can be done with a touchless sale.

Cash

As we already discussed, cash is largely dependent on months to recover CAC. The faster you can recover the money you spent on acquiring a customer, the more profits you will earn in the long run. Depending on the SaaS business, there are two ways to look at this: The business either receives monthly payments, or they can receive all the money upfront with the help of long term contracts with each customer. This way, a customer may agree to use the services of your company for 6, 12, 24 or 36 months and pay all the money upfront.

Why is this important?

Since a SaaS business needs to make a lot investments into acquiring customers to later generate profit over a long period of time, getting the money upfront will help speed up the process, because you can reinvest that money into the business and boost customer acquisition rates. Also, there will be a difference between your cash flow profitability and revenue profitability. In the case of long term contracts, you will receive more profit during a single month than you can recognize as profit (since your model is based on MRR). This is why it’s important to keep an eye on your cash flow profitability instead of revenue profitability, since it will give a more accurate view of the big picture. Most SaaS businesses make the critical mistake of focusing on revenue profitability and new customer acquisition rates, while ignoring months to recover CAC, churn, and long term contracts. If you are only utilizing month over month payments, the cash flow and revenue profitability are the same for you, but in the case of long term contracts, it’s critical to focus on the cash flow profitability and use that figure in your calculations, planning and strategy.

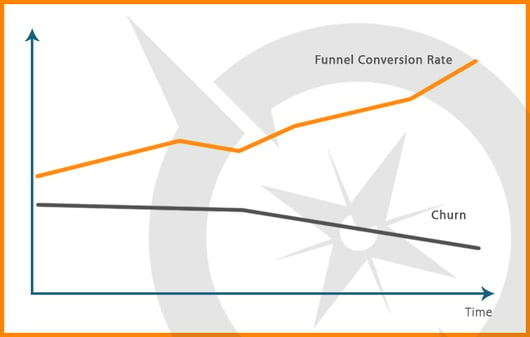

To summarize, we can see two metrics that are crucial for a SaaS business: churn rate and conversions. Here is a graph showing what you should be aiming for:

Customer Profitability (Marketing and Sales ROI)

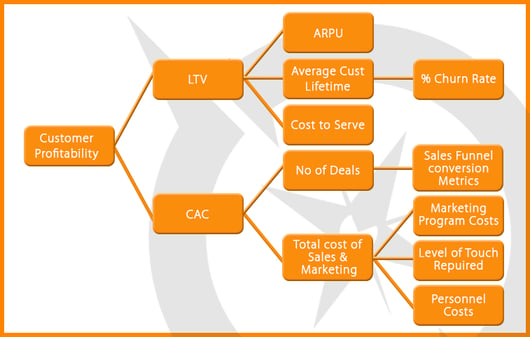

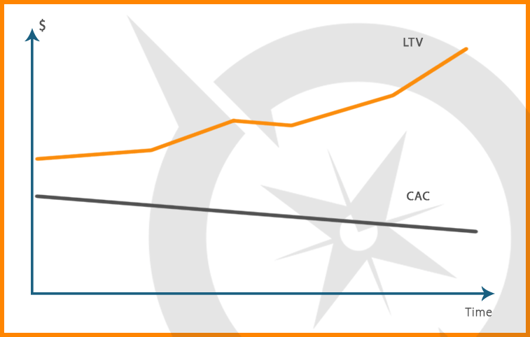

“Measuring your marketing ROI is like using a map. Without it, you don’t know where you’re going and don’t know if you’re moving in the right direction. It’s key to any marketing initiative and should be a high priority for every marketer.” – Matt Gratt, Marketing Manager of BuzzStream Customer profitability is basically the ROI of your sales and marketing. It depends on two key variables: customer lifetime value (CLV) and customer acquisition cost (CAC). Here is a graph showing the detailed relationship between those two metrics

To calculate ROI you need the following formula:

Your major goal is to increase the CLV as much as possible and/or minimize the CAC as much as possible in the meantime. In order to understand what you can do to achieve this, let’s take a look at a detailed overview of CLV and CAC:

Customer lifetime value – CLV

To calculate the CLV you need the following formula:

Average lifetime of a customer is equal to 1/churn%. This means that if you have a churn rate of 10%, for instance, your average lifetime value per customer will be equal to 1/10% or 10 months. Now if we want to maximize LTV, we need to do one (or all) of the following:

- Increase average revenue per customer

- Increase average lifetime per customer

- Decrease service costs

From the three variables above, decreasing service costs is very hard to do. Service costs include customer support, maintaining your internal IT team, etc. These are largely fixed costs that cannot be decreased easily. You will either have to lower salaries or pay lower rent for equipment or something else of that sort. Increasing the average revenue per customer is easier, but still requires a large deal of work. For example, you need to upsell new features (which you might not have yet) or charge some customers more (large companies mainly). Increasing the average lifetime of a customer is technically the same as decreasing the churn rate (as you can see from the formula). Now this is a metric that can (and should!) absolutely be taken into account seriously. From the equation it’s clear that if you can halve your churn rate, you will directly increase LTV by twice as much.

If you have a high churn rate, then you clearly have a problem with customer satisfaction and need to look into that matter as a top priority before doing anything else.

The tricky part about churn is that it can vary greatly month over month and looking at it from a single customer’s perspective on a monthly basis can give you a false idea. This is why you want to look at the churn rate from a larger perspective, taking a group of leads that became customers thanks to the same marketing/sales activities/campaigns and measure their churn rate as a group’s average. The number that you are really looking for is the percentage of churn over a 12 month period, since it’s the most important number for your months to recover CAC calculations.

Customer Acquisition Cost – CAC

To calculate CAC you need the following formula: CAC=total costs of sales and marketing/number of customers acquired When looking at the total cost of sales and marketing, we are actually interested in two critical metrics: total marketing costs and costs associated with your sales teams (sales activities and maintaining sales personnel). The number of customers acquired directly depends on your lead generation growth, conversion growth and funnel capacity growth. Using the same principle as above, to minimize CAC we need to do one (or all) of the following:

- Decrease marketing costs

- Decrease sales costs

- Decrease sales personnel costs

- Increase the number of customers acquired

Decreasing marketing costs is one of the hardest and most tricky things to do. As a SaaS business, you are heavily reliant on marketing activities to generate visitors, leads and customers, so decreasing marketing costs might end up being a very poor approach. Decreasing sales and sales personnel costs is possible if your company embraces the approach of touchless sales. This brings us back to the point of inbound marketing being one of the most effective ways to grow a SaaS business. Just like a SaaS business, inbound requires upfront investments, but will reward you later with lower per lead acquisition costs, constant flow of high quality leads and (arguably) overall lower marketing costs, if you heavily invest in high quality content generation, social media, SEO and email marketing. To increase the number of customers acquired, there are a few things that you can do: invest heavier in marketing activities, decrease sales cycles and increase conversions. As you can see all of these points directly relate to inbound marketing as well, since with less sales touches (in an ideal scenario, inbound marketing can bring in customers without any sales call whatsoever) your sales cycles will be shorter, thus you will acquire new customers sooner and increase the overall number of acquired customers. At the end of the day, the key is to have a graph that looks like this:

Also, proper content marketing, SEO and email marketing can help improve the efficiency of your marketing activities, which is technically the same as investing more into marketing, only using less resources – a double win situation. Calculating marketing and sales ROI is very tricky and easy to lose track of. In the above examples, we used simple models that take into account one customer – imagine how complex it becomes to keep track of hundreds of customers and leads at the same time. Since marketing and sales are the main profit drivers for a SaaS business, you need to keep a close eye on the key metrics described above: CAC, LTV, churn rate and conversions. Decreasing CAC and churn rate, while maximizing LTV and conversions is the key to improve the ROI of your marketing and sales activities, and thus, drive your business forward towards success.

Tags:

SaaS Sales

July 21, 2020

Comments